The minor change implies that 5% GST that was before paid by eateries on food request will presently be paid by stages like Zomato and Swiggy. This will help in checking tax avoidance

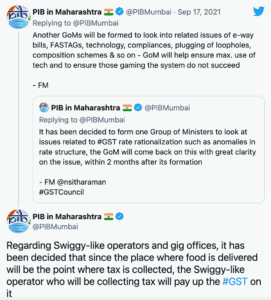

Money Minister Nirmala Sitharaman, talking on the result of the 45th GST Council meeting in Lucknow today, said there is no new expense on online food-conveyance administrators like Zomato and Swiggy, however they should pay 5% GST on eatery administration offered by means of them.

These assessments, Sitharaman said, will be charged at the hour of conveyance. This implies that 5% GST that was before paid by eateries on food request will presently be paid by food conveyance organizations like Zomato and Swiggy. The pastor explained that it’s anything but another assessment and that end-clients won’t need to pay additional cash. The minor change is pointed toward keeping away from tax avoidance, which on account of cafés was predominant. assessment will settle up the GST on it,” Sitharaman said.

Administrations by cloud kitchens or focal kitchens are covered under “café administration”, and draw in 5%, without ITC, the priest said. She additionally explained that alcoholic alcohol for human utilization isn’t “food and food items for the passage endorsing 5% GST rate on work administrations concerning food and food items”.

MS Mani, Senior Director, Deloitte India, said: “While food conveyance administrations would comprise web based business administrations, adequate shields should be taken in exposing them to GST to guarantee that more modest food outlets are secured and shoppers don’t wind up paying more.”

In the interim, the Council expanded concessional charge rates on certain COVID-19 medications by 90 days till December 31. The Council, which involves the Union money clergyman and her state partners, chosen to keep keeping petroleum and diesel out of the GST domain as subsuming the current extract obligation and VAT into one public rate would affect incomes.

Money Minister Nirmala Sitharaman additionally said GST has been absolved on strong decay drugs like Zolgensma and Viltepso, which cost crores of rupees. It additionally expanded the time of concessional GST rates on certain COVID-related medications by 90 days till December 31 yet chose not to give a similar advantage to clinical hardware. GST Council likewise suggested new footwear and material rates from January